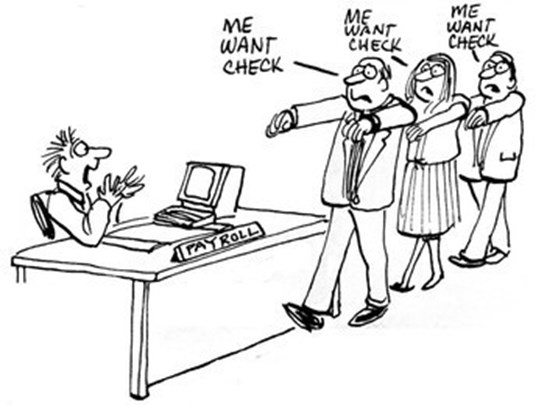

Making payroll is one of the most challenging parts of managing cash flow. Business owners like you may run into cash flow shortages for many reasons. Two of the main reasons are accounts receivable and payroll. Sometimes your customers do not pay you on time, but you still must pay your employees on time! Slow-paying customers affect your cash flow and can cause issues funding your payroll.

Have you considered an asset-based loan to help bridge your payroll gaps? You work hard to run your business and drive growth, while at the same time worrying about cash flow for payroll. An asset-based loan can be a great tool to relieve financial stress.

So, what is an asset-based loan?

Asset-based loans are loans you can access without any credit check, regardless of other loans you may already have. They are based on an asset you own which is pledged against the loan proceeds.

One resource many business owners use is MyBridgeNow located in Burnsville. Like all asset-based short-term lenders, they will evaluate your assets and lend you cash, giving you the liquidity your business needs, and they do it in a matter of minutes. They can loan between $5,000 to $500,000 with rates as low as 4% to bridge the gap between when your payroll is due and when your customers pay you.

Asset-based lenders accept a wide range of assets and can give you access to cash quickly. Here is a partial list of the types of products they take: construction equipment, small equipment, RVs, boats, trailers, cars, power sports, motorcycles, jewelry, coins, luxury watches, and more.

If you experience these cash flow issues in your business, call Ivan today and find out how MyBridgeNow can help alleviate the stress caused by cash flow challenges!